SAP Controlling (CO) - a complete guide

- SAP CO overview

SAP CO is also a very important functional module, that helps an organization manage and configure the master data about profit and cost center. CO also enables businesses to optimize, monitor, and coordinate all the processes. With the help of CO organization is able to record the product factors and services to reach out to more customers. The main purpose of using CO is all about planning inventories and controlling the workflow of business organizations. - A brief about SAP CO submodules:

There are 7 sub-modules that make SAP CO more effective and beneficial in any organization.

Let’s know them one by one;

- Cost element accounting: this type of CO offers a complete guide to revenue and profit services in an organization. Most of the revenue values will be moving automatically from financial accounting to controlling. Cost element accounting calculates only costs or other expenses in financial accounting.

- Cost center accounting: the main functionality of using cost center accounting is to control financial activities in an organization.

- Activity based accounting: this type of Controlling module is used to analyze the multi/cross-departmental business process.

- Internal orders: internal orders in an SAP controlling is to provide full analysis about the job incurred. With the help of internal orders, budget assignment is also possible that will be monitored by the system to make sure that the given inventory values should not exceed the budget value.

- Product cost controlling: this usually calculates the cost of the product manufacturing and service provider. It also allows consumers to calculate the price that compares with market value.

- Profitability Analysis: this submodule calculates the profit or loss of an organization on the basis of market segments. You can consider profitability analysis as a decision making, for example, it is used to describe the price, conditional statements, and market segments.

- Profit center accounting: this is used to evaluate the profit or loss of an individual or an independent area in the organization. It also calculates the revenue generation of the specific products.

Want to Become a Master in SAP Success Factors? Then visit here to learn SAP Success Factors Certification Course from hkrtrainings

SAP CO- cost center

A Cost center is defined as a component of an organization that adds up the cost and profit values indirectly. The best example for Cost center is Marketing and customer services.

A cost center can be further divided into three sub-components they are;

- Profit center

- Investment center

- Cost center

The simple and straightforward method used in an organization is a cost center because it’s easy to measure.

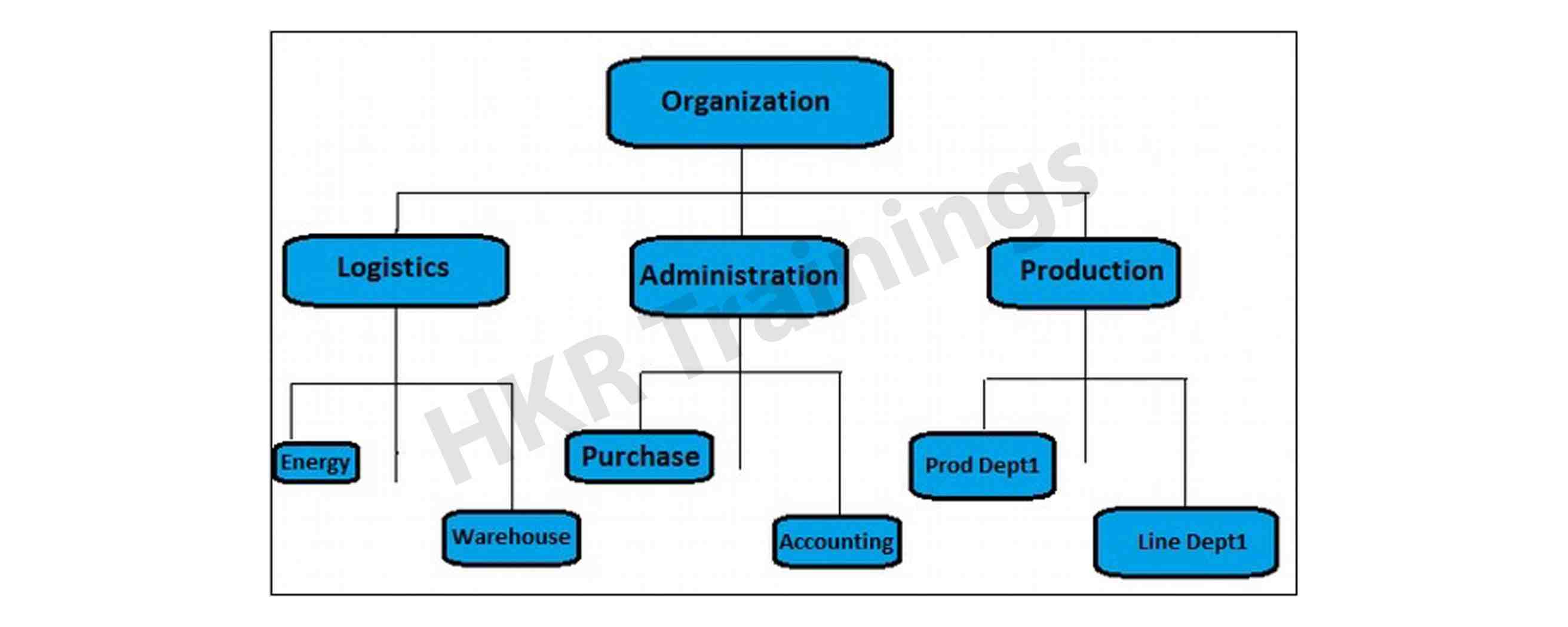

Now we will discuss how does Cost center hierarchy look like;

SAP Training

- Master Your Craft

- Lifetime LMS & Faculty Access

- 24/7 online expert support

- Real-world & Project Based Learning

How to create a cost center?

Now let’s see step by step guide to creating a cost center;

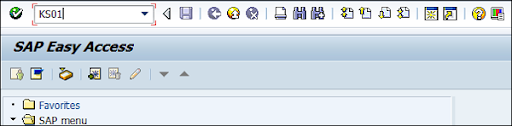

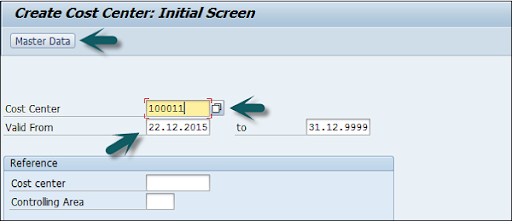

- Use the transaction code KS01 to create the cost center, the result window as shown below;

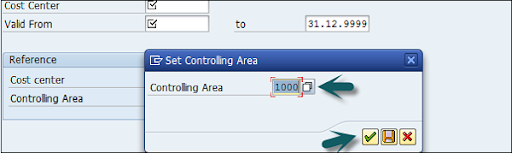

- Now enter the controlling area, and put the right mark;

- In the next step, enter the below details;

Provide a new cost center number.

Validity of the new cost center as shown below;

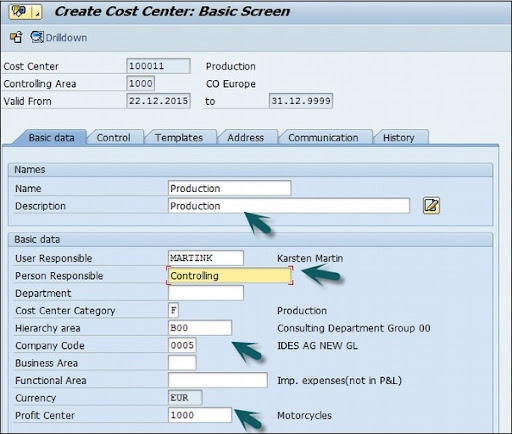

- Click on the metadata, the new window will be popped up, give the following details;

- Enter the name of the cost center

- Enter the description

- Enter the user and person responsible

- Cost center hierarchy

- Hierarchy area

- Company code and profit center details

- At the end, click the “save” button.

Click here to get latest SAP interview questions and answers for 2023!

Subscribe to our YouTube channel to get new updates..!

SAP CO- internal orders

The internal orders in CO monitor the cost and revenue of an organization. The below are the few scenarios where you can make use of internal orders;

- Internal orders help the organization to monitor the cost of a time-restricted job or product activities. In rare cases, it can be used to monitor long-term costs.

- Investment costs related to fixed assets can be monitored using the investment orders.

- Anything period related calculations in FI, cost-based debits, and accurred cost value.

- Costs and revenue incurred for the external partner activities and core business activities are monitored by order with revenues.

SAP CO- cost center

SAP CO profit center manages the internal control of an organization. Once you divide your organization into profit centers, that will allow into delegate responsibility to decentralize units and make them a separate company within the profit center. This also calculates the key figures in cost accounting such as ROI (rate of interest) and cash flow etc.

The profit center is a part of the enterprise controlling module and also integrates with the new general ledger accounting.

Key features of profit center:

The profit center accounting usually monitors the internal cost and profit of an organization. The below are the important key features of a profit center;

This profit center allows organizations to analyze the fixed assets and in many cases, they can be used as investment centers.

It also allows you to expand profit centers into investment centers.

Want to Become a Master in SAP Success Factors? Then visit here to learn SAP MM Online Course in Pune from hkrtrainings

Why does an organization need a profit center?

The main purpose of creating a profit center in any organization is to analyze the total cost of the product line and business units.

With the help of a profit center in CO, you can also generate a profit and loss ledger, and balance sheet maintenance. However, the Profit center is mostly used for internal purposes only.

The key components of Profit center:

The following are the major key components of the profit center;

- The name of the profit center

- The controlling area which is being assigned

- The time period of the total cost

- A person responsible for the profit center

- Standard hierarchy.

SAP CO - product costing

The product costing is an important module of SAP CO that is used to find the internal value of the product. The main purpose of adopting product costing in any organization is to know the complete value of the profitability and account management for the production.

While configuring the product costing, you need to be aware of these two things;

- Product cost planning

- Cost object planning

The basic thing of product costing is “cost center planning”. The main aim of using cost center planning is to know total dollar billing and the quantities of each product in a plant.

Creation of product costing:

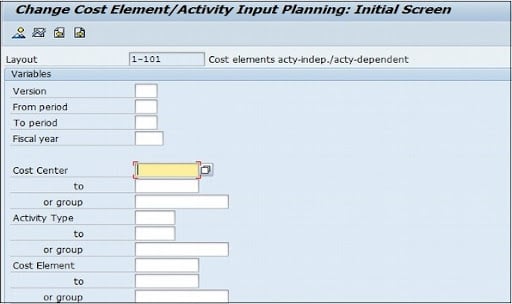

The T-code is used to create product costing is KP06-> then enter the controlling area details.

The cost center planning is done by activity type and cost elements. You can also create the variable and fixed dollar amount.

The product costing window looks like this;

To specify the cost center quantities use the T-code and you can also manually enter the activity rate which is based on a yearly rate.

Want to Become a Master in SAP CPI? Then visit here to learn SAP CPI Training from hkrtrainings

SAP CO - Profitability analysis:

SAP controlling profitability analysis helps to analyze the market segments such as products, consumers, sales area, and business area.

SAP CO profitability analysis can be further classified into three categories such as;

- Products

- Orders

- Customers

Points to remember:

Profit analysis market segments can be of any types like;

Combination of products, orders, or customers.

Strategic business units may be of the sales organization.

Business areas or company’s profit.

Contribution margins.

Profitability analysis supports two methods such as;

Costing based profitability analysis:

This type of profitability analysis groups the costs and revenues values as per the fields. It also gives the short-term and complete profit values.

Account-based profitability analysis: it is used to define the profitability report within the financial accounting. This is mainly used for gathering information on sales, marketing, corporate planning, and product management.

Related Articles SAP SD Enterprise Structure !

Key components of Profitability analysis

The below are the key components of profitability analysis;

Actual posting: this component allows you to transfer the sales order and billing documents from sales and distribution into real-time Controlling profitability analysis. Even with the help of a PA you can also able to transfer costs, cost center, orders, projects, and revenues from direct posting to profitability segments.

Information system: this component allows the business centers to analyze the existing data from a drill-down function in a reporting manner. The purpose of using the drill-down function is to manage the reporting data in a standard hierarchy structure.

Planning: Planning is an essential component of profitability analysis and allows you to create sales and profit plans. The most commonly used one is manual planning, which defines the planning screens for your organization. With the help of manual planning, you can perform tasks like data planning, creating forecasts, and calculating planning.

SAP CO -planning methods:

SAP CO planning strategy enables organizations to plan for the dynamic segments as stated in the packages planned.

There are 2 types of the planning methods available,

Manual planning: this type of planning allows organizations to plan cost information and display them in the profit segments.

Automatic planning: this type of planning allows organizations to make use of methods like a copy, as well as top-down distributions, delete, and planning of profitability segments.

Related Articles what is SAP SD !

Conclusion:

Enterprise resource planning is a mandatory thing to manage the organization resources, you can take from manpower to financial planning. When it comes to financial planning, SAP CO plays a vital role in managing and controlling the cost, loss, and profits. From this article, you may get a piece of useful information about CO’s different methods, and how to manage cost centers to achieve successful profitable outcomes.

Related Articles SAP SD Flow !

About Author

Kavya works for HKR Trainings institute as a technical writer with diverse experience in many kinds of technology-related content development. She holds a graduate education in the Computer science and Engineering stream. She has cultivated strong technical skills from reading tech blogs and also doing a lot of research related to content. She manages to write great content in many fields like Programming & Frameworks, Enterprise Integration, Web Development, SAP, and Business Process Management (BPM). Connect her on LinkedIn and Twitter.

Upcoming SAP Training Online classes

| Batch starts on 26th Feb 2026 |

|

||

| Batch starts on 2nd Mar 2026 |

|

||

| Batch starts on 6th Mar 2026 |

|