- Introduction to SD Tax Determination

- Define Tax Category

- Examples for Tax Determination

- Tax Types

- Define the Material Taxes

- Define the Tax Determination

- Conclusion

Introduction to SD Tax Determination:

SAP uses conditional statements to calculate the tax, and in many cases, these conditional statements cannot be used to withhold the tax.

Tax calculation defines the following parameters they are;

- Tax types

- Calculates the amount types/ data entered.

- GL (general ledger) for posting the tax.

- Helps to calculate the additional tax.

In the SAP system, we can find the following field entries;

- Steps: This field defines the sequence of tax within the procedure.

- Conditional Types: This field defines how the tax calculation workflow operates.

- Reference Steps: This field enables the system to obtain the value/amount for the calculations.

- Account or Process Key: This field offers the link between the tax procedures, and the General ledger (GL) account, where the tax can be posted.

Define Tax Category:

In general, the tax category in the SAP SD is used for maintaining or grouping similar types of product rates or service tax rates. Usually, tax rates define the product tax codes. The tax rates are linked to types of tax, and that will be included in the tax procedures.

Wish to make a career in the world of SAP SD? Start with HKR'S SAP SD online training !

Important points to remember while working on the tax category:

- A single tax code can consist of multiple tax rates for various tax types.

- Each tax code is assigned to a tax procedure, then it will be attached to the general ledger master record.

- Users are able to access the specific tax procedure only when a general ledger account is used in the processing of sales documentation types.

The steps include creating the tax category:

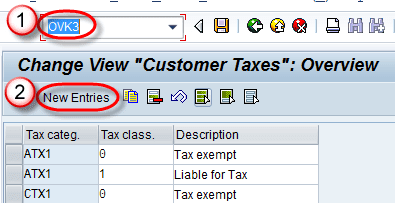

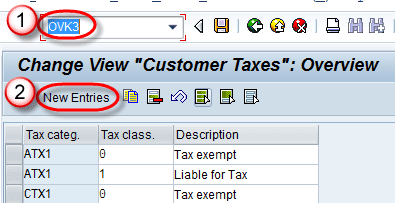

- First, go to the SAP easy access menu -> type the t-code OVK3 -> click enter to proceed further;

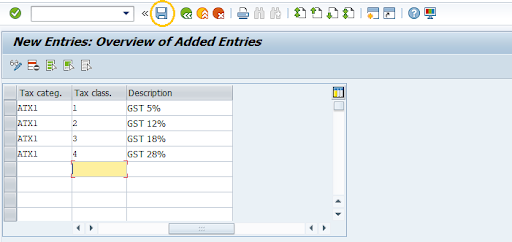

- Now click on the “new entries” button, the following window will pop up;

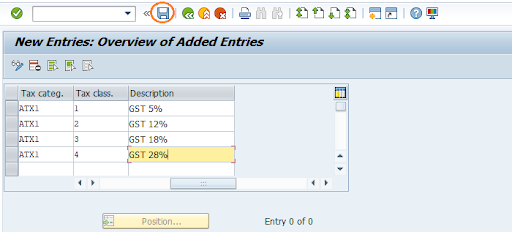

- Now enter the following required details

Tax Categ (category): Choose the tax category from the list.

Tax Class: Here you need to enter the tax class.

Description: Give the description as per the product.

- Once done with entering all the details -> click on the “save” button to save the details.

- Now the status bar displays the below notification once the tax category details are saved successfully.

Example for Tax Determination:

Assign the plan for tax determination:

The steps include are;

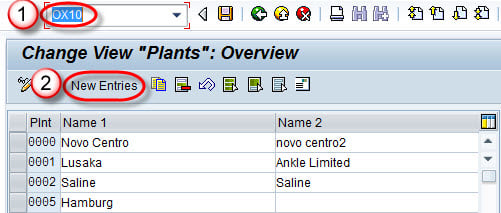

- Go to the SAP easy access menu -> type the t-code OX10 -> click enter;

- In the next window screen -> click on “entries” as shown below;

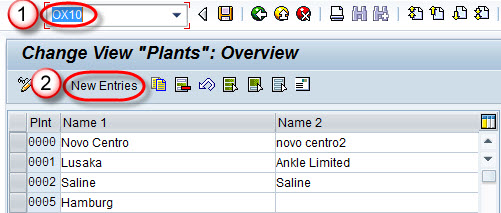

- Enter the following details -> click on “enter”.

Plant: Give the plant name.

Name 1: Give the name to a plant.

Country Code: Select the country code from the given list.

City Code: Select the city code from the given list.

- The below image describes how to give all the details;

- Once you have given all the details -> click on “save” to save all the entries.

SAP SD Training

- Master Your Craft

- Lifetime LMS & Faculty Access

- 24/7 online expert support

- Real-world & Project Based Learning

Tax Types:

In SAP, there are three major tax types available, they are;

1. Tax on Sales and Purchase:

- Tax on sales and purchases can be levied on every sales transaction that is based on VAT (value added tax).

For example, the VAT value is differentiated into input and output, Input tax is a type of net invoice amount, which is charged by vendors whereas the output is calculated using the product's net price, which is charged by the customers.

2. Additional Tax:

- Additional tax is also a type of tax that calculates the additional tax based on the sales or purchase. Additional tax can be of the following types;

A. Inventory taxes.

B. Sales equalization taxes.

3. Sales Tax:

- Sales tax is the tax that is generated from product sales.

An example for sales tax;

Suppose you want to resale the products to a third-party vendor, if it is untaxed, then the third party vendor does not add the tax while purchasing.

Get ahead in your career with our SAP SD Tutorial

- The SAP system calculates the sales tax on the basis of customer location and the materials in the material management and sales/ distribution functions.

How to create a tax type?

In this section, we are going to explain how to create a tax type;

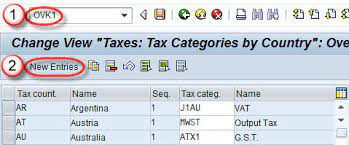

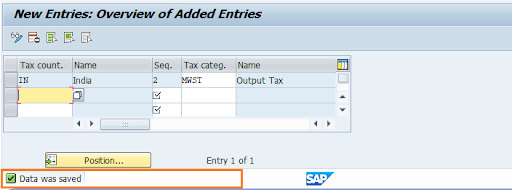

The steps include are;

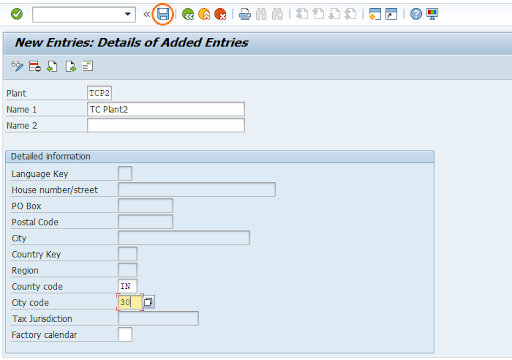

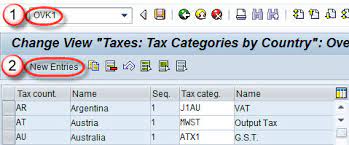

- Go to the SAP easy access menu -> type the t-code OKV1-> click enter to provide the details;

- In the next window screen enter the data -> click on the “new entries” button as shown below;

- Now enter the below details;

Tax Country: Select the tax country from the given list.

Seq: Mention the sequence number.

Tax Categ: Select the tax category from the given list. - The below image describes the entries;

- Once done with all the data entries -> click on the “save” button to save the data.

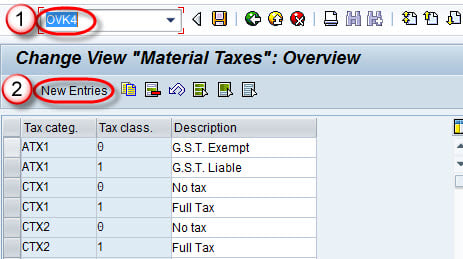

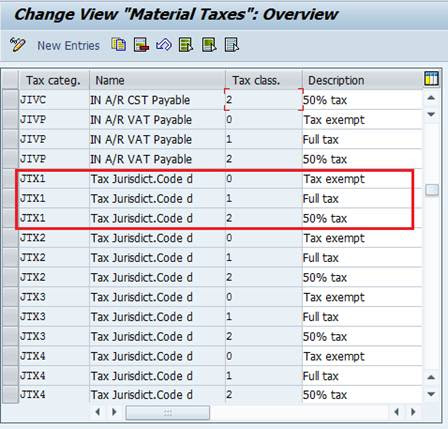

Define the Material Taxes:

The material tax in SAP determines whether the material is full, half. Or not liable for the tax calculations. Due to this material tax, users can also define the different tax rates, and also be able to change them according to the customer requirements.

Subscribe to our YouTube channel to get new updates..!

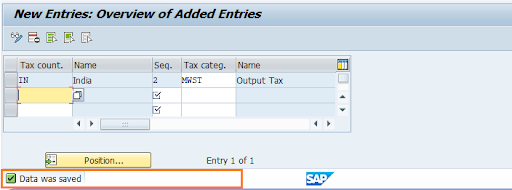

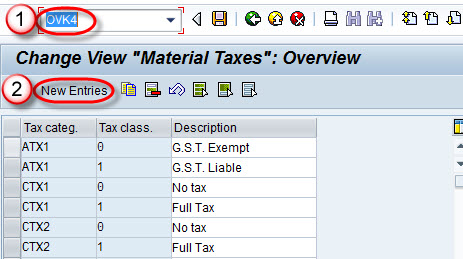

How to create a material tax?

The following steps define how to create a material tax in the SAP system,

- Go to the SAP easy access menu -> type the t-code “OKV4” as shown below;

- Now click on the “new entries” button to define the new entries for the material tax as shown in the below image;

- Enter the below details -> click the “enter” button;

Tax Categ -> Enter the tax category details.

Tax Class -> Mention the tax class name.

Description -> Give the appropriate information about the tax category.

- Once done with all the data entries -> click on the “save” button;

- Now you will get the message as “entries have been saved successfully”.

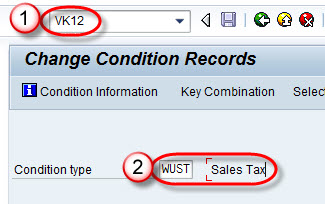

Define the Tax Determination:

In the SAP system, the tax determination is used to determine the condition of the tax types. Each tax condition type defines the tax applicable to the country and also specifies the valid country tax types.

How to create tax determination in the SAP system?

The steps include are;

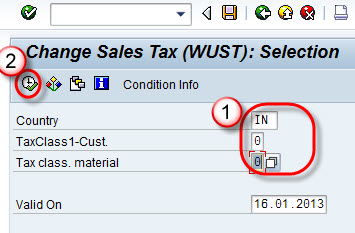

- Go to the SAP easy access menu -> type the t-code VK12 -> then the new window will pop us as shown below;

- In this new window enter the condition types -> click enter;

- In the key combination window -> select the option “domestic taxes” -> click on the right tick mark.

- Now enter the below details -> click on the “run” button;

Country: Select the country name from the given list.

Tax Class1-cust: Enter the class1 tax customer names.

Tax Class Material: Enter the tax for the materials.

- The below image consists of these details;

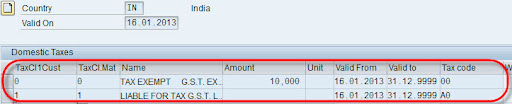

- Now enter the below fields:

Customer tax class

Material tax class

Amount details

Validity periods and tax codes. - The resulting image is shown below;

- Now click on the “save” button to save all the data entries:

Conclusion:

We have been working continuously to help you out in the learning process of SAP sales and distribution functional module then we thought why not explain about Tax? Here you go, the “final article”. In this tax determination article, you will get a chance to learn more about tax types, tax categories, material taxes, and tax determinations. I hope you people are enjoying our articles on SAP, stay tuned for more articles.

Other Related Articles:

About Author

Kavya works for HKR Trainings institute as a technical writer with diverse experience in many kinds of technology-related content development. She holds a graduate education in the Computer science and Engineering stream. She has cultivated strong technical skills from reading tech blogs and also doing a lot of research related to content. She manages to write great content in many fields like Programming & Frameworks, Enterprise Integration, Web Development, SAP, and Business Process Management (BPM). Connect her on LinkedIn and Twitter.

Upcoming SAP SD Training Online classes

| Batch starts on 23rd Feb 2026 |

|

||

| Batch starts on 27th Feb 2026 |

|

||

| Batch starts on 3rd Mar 2026 |

|